So, the whole idea of updating on a per-month basis quickly fades away with changes in my life. It is also not feasible to update as regularly as I could have done so in 2020. Eventually, the updates plateaued for a shocking 2 years where many of my decisions were to take profit and reduce positions and were too difficult to document in detail.

Nonetheless, we can proceed for a fresh 2024 and hopefully be about to stay disciplined about everything else on investment, family, work, and health. We have to always keep our hopes and maintain the discipline for everything.

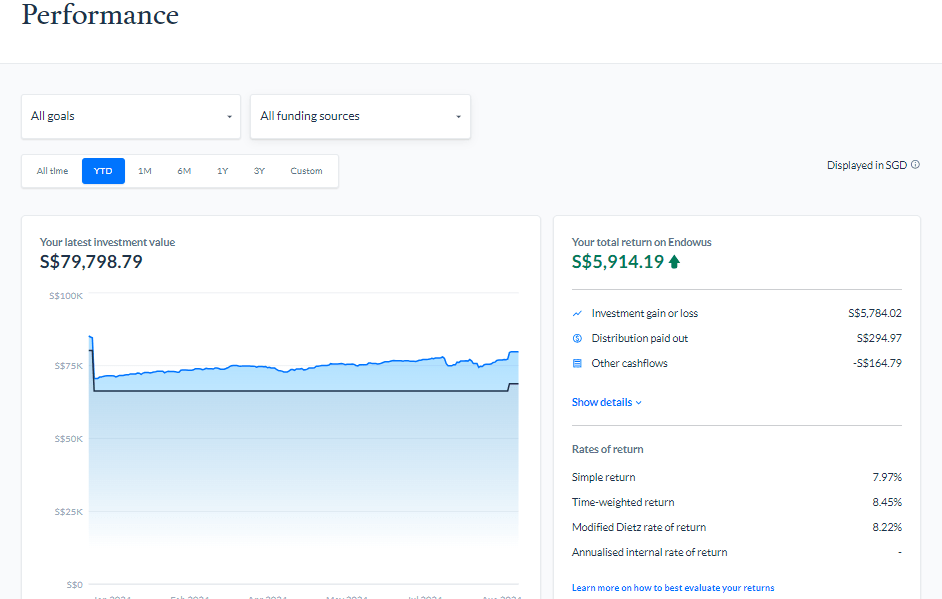

This is a YTD performance. This year it is up almost 6k which is decent in my opinion. In the last 3 years, the entire portfolio is up about 20%. That makes it annualised around 6.5% p.a. which is palatable. The main idea is to stay invested.

Portfolio Summary

Two years have gone by and interest rates have been the talk of town. Gone are cheap money but in Singapore Real Estate prices are still pretty crazy and will still continue to be. Meanwhile, surprises in the S&P 500 and Nasdaq indices in recent weeks have been rather interesting, breaking upwards followed by a couple of down days. No one has that crystal ball on hand. We just have to understand the concept of being brave and buying it low and riding the high waves when Mr Market picks up.

Performance of the different portfolios in different advisors

During the pandemic, there were a lot of people doing interesting business and many specific sectors boomed like a million times. When the world opened up, it was both amazing and scary that many of these businesses were no longer relevant. That included some of the robo-advisors. Of course, 90% were expected. Some of those unexpected ones probably came from MoneyOwl. My personal experience with Income and the way they work is rather unimpressed so it has to be a management decision that closed that down. Leaders have to take a stand and sometimes they can be wrong however, I only see leaders trying things out without a clear understanding of the final goal. This was probably one of those incidents in a big corporation.

Politics – They say. To me, I’ll say that it is more like a face-saving grace or a change of mind. Probably a top-down approach to ‘why or who did this?’ It can be pretty lame to hear that. I’m not a fan of finger-pointing but that’s the sad reality even as adults. We can’t even have a proper conversation about what went wrong.

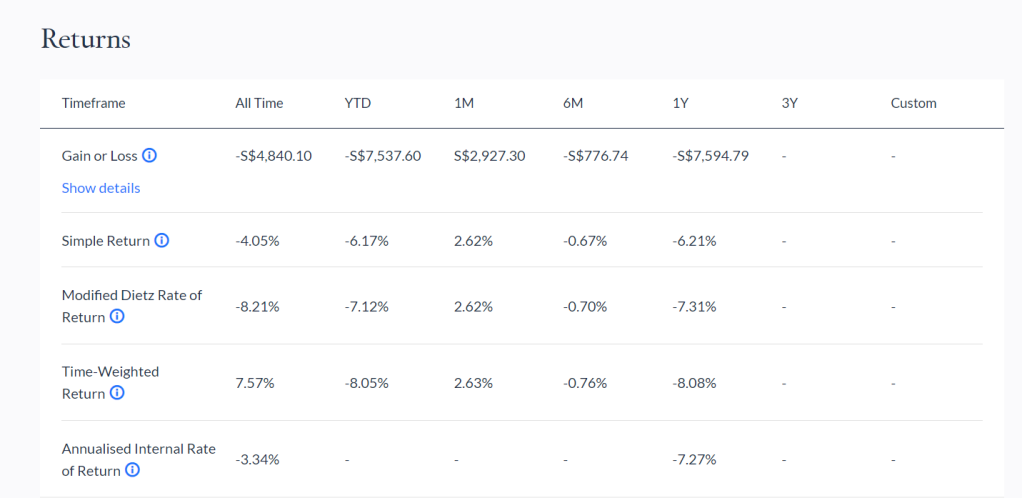

Enough of the comments, these are the performances since inception. I prefer to talk about absolute returns in dollars and sense. Not in percentages or year-to-date or month-to-date comparison. Unless I’m comparing of some sort, I probably would like to talk about the true profits or losses.

Currently, What I have now is a few of these active platforms;

- Moomoo Brokers

- Tiger Brokers

- Endowus

- Asia Wealth

- Crypto Portfolio

I can’t help but think that overall, Endowus really works well for me.

If you decide to sign up with Endowus, do remember to use my referral code: https://endowus.com/invite?code=EDZ8M

Endowus – Cash Fund Ultra Portfolio

This was bad. No one took responsibility but I cut it and earned it all back with a money market fund coupled with promotional cash deposit fresh funds. Keeping it in the same cash fund did not do me any good. That’s a done deal so we move on.

Endowus – ESG Portfolio

I started this ESG Portfolio in March 2021 and I have some high hopes for this fund to do pretty well. They do well for the investment portfolios. Not too much for cash funds.

The allocation is an 80%/20% Equity/Bond portfolio allocation so there will be more movement on the equity side. This is long term so, just leave it in there. You do good and it brings you sustainable returns. It is for the future and the next generation. I can’t explain more.

This is good. Overall up 17.96%.

Endowus – SRS Portfolio

Overall, the portfolio is still up +34.56% since May 2020 in SGD. As usual, in USD terms, due to no FX impact as the portfolio is USD ETFs, the performance will definitely be better especially when USD becomes stronger. Of course, the reference will be SGD since I use SGD. This SRS/Cash portfolio consists of my favorite Dimension Funds in 40% bonds/60% equity.

Overall from May 2020 to Aug 2024, it is a +34.53% increase in absolute terms – quite okay. This is for the long run. I’m just going to keep it simple to report it overall as I have less time on my hand these days. But do try it out and put out your own performance and tell everyone about the experience. Unless you nitpick aggressively – I think you will be fine. YTD, it is definitely down.

Endowus – CPF Portfolio

The CPF portfolio is looking at +21.04% since its inception in May 2020. That’s a huge drop of almost 9% from its all-time high. This portfolio is being beaten down for now.

The portfolio is doing well.

Endowus – Fund Smart Portfolio

I started this semi-medium-term Fund Smart portfolio this month in May 2021. I tried to build a balanced portfolio. I’m not exactly sure but I will go in via RSP monthly as I wasn’t sure but I do want to deploy some of my cash. The all-time absolute return is +0.58%. haha. This is done monthly on RSP until 2021. I stopped that contribution a year ago since I had a small China play which did not pan out well but still. This is a 20 years portfolio.

Overall: 52% Equity and 48% Fixed Income

a. 15% in Multi-Asset Fund (1 Fund)

b. 45% in Equity Funds (2 Funds)

i. Focus on China Play [10%]

ii. Global equity with dividend accumulation (Re-invest) [20%]

iii. Small Cap equity play (For the Alpha) [15%]

c. 40% in Bond Funds (3 Funds)

i. Climate Bond Fund Play [20%]

ii. Core Fixed Income Play [20%]

Endowus – Retirement Portfolio 1

I got down into building a portfolio of unallocated funds to the institution Pimco GIS Income Fund. 0.55% will be the fees annually so that’s going to be the start of the accumulation of the coupons from the funds. I am down -5.22% for March 2024 and with the current news it is at +2.98% for Aug 2024

Endowus – Retirement Portfolio 2

Yet again, I put in 2 tranches of S$5k into the Lion Global Infinity 500. At one point it was close to 6-7% down and this month it is +3.47%. Real volatility, is expected and still strongly convicted on this one.

Overall, absolute returns are at +29.64%. Surprising because at one time it was down for a bit.

Endowus – Income Portfolio

I initiated this 6-8 months ago. Hopefully, over time the income portfolio can be passed on to my kids to continue as a form of RSP. Returns are pretty good now. Close to 20% returns on income given that the year has not ended.

Endowus – New China Portfolio

This is a new one that I put into. This is a long-time view given the current valuations. It looks good. I am willing to take some risks.

AutoWealth – Portfolio

Yet again, I put in 2 tranches of S$5k into the Lion Global Infinity 500. At one point it was close to 6-7% down and this month it is +3.47%. Real volatility, is expected and still strongly convicted on this one.

Tiger Brokers – Trading Platform

Yet again, I put in 2 tranches of S$5k into the Lion Global Infinity 500. At one point it was close to 6-7% down and this month it is +3.47%. Real volatility, is expected and still strongly convicted on this one.

Crypto – Portfolio

Crpyto finally went back to normal and my portfolio is back to the place it was 2 years ago. It has been rather hurtful for the past 2 years or so. All those additional profits are gone as no profit taking took place. Perhaps it is time to review about taking a portion out once more once the trend sets in and takes off again. The season is still higher but still currently plateaued.

The reason for Endowus (As sustainable as it is)

Like a broken recorder, the pros once more:

- Endowus is the first and only robo-advisor to be approved by the CPF board.

- 100% trailer fees back to the consumer, not the fund management fee. This is really one of a kind I’ve seen so far.

- They do have a decent team that makes sense when introducing their platform in my personal opinion.

- I believe all retail investors should try them out because of how they are trying to disrupt investing and make investing work for everyone.

Thank you all in advance for using my referral code. They are not perfect but in my opinion good investment strategies.

The last point is to do your own diligence. What works for me may not work for you. Investing in traditional portfolios is about risk management.

Disclaimer

If you decide to sign up with Endowus, do remember to use my referral code: https://endowus.com/invite?code=EDZ8M

If you like what I am sharing or if it resonates with you, do use my referral codes for other services at Referral and Recommendations

These pictures were taken off the internet websites for reference.