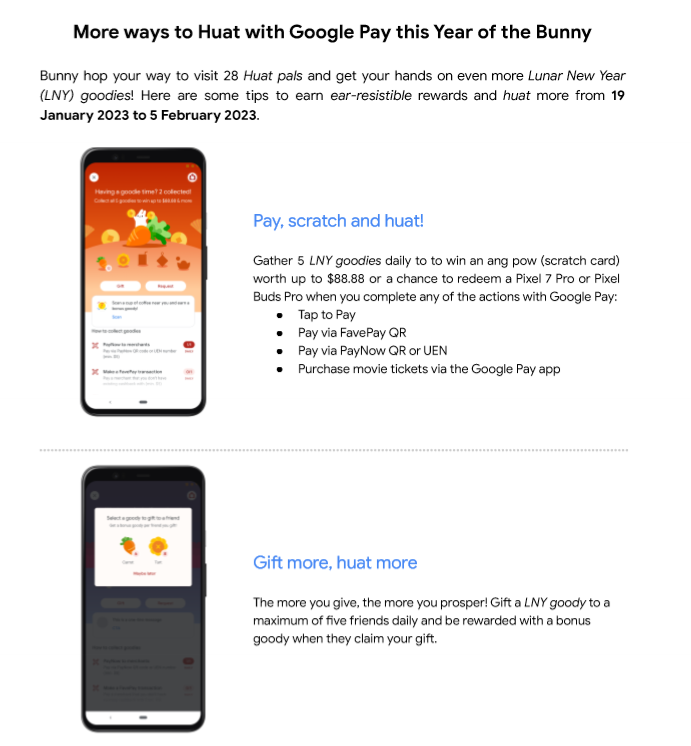

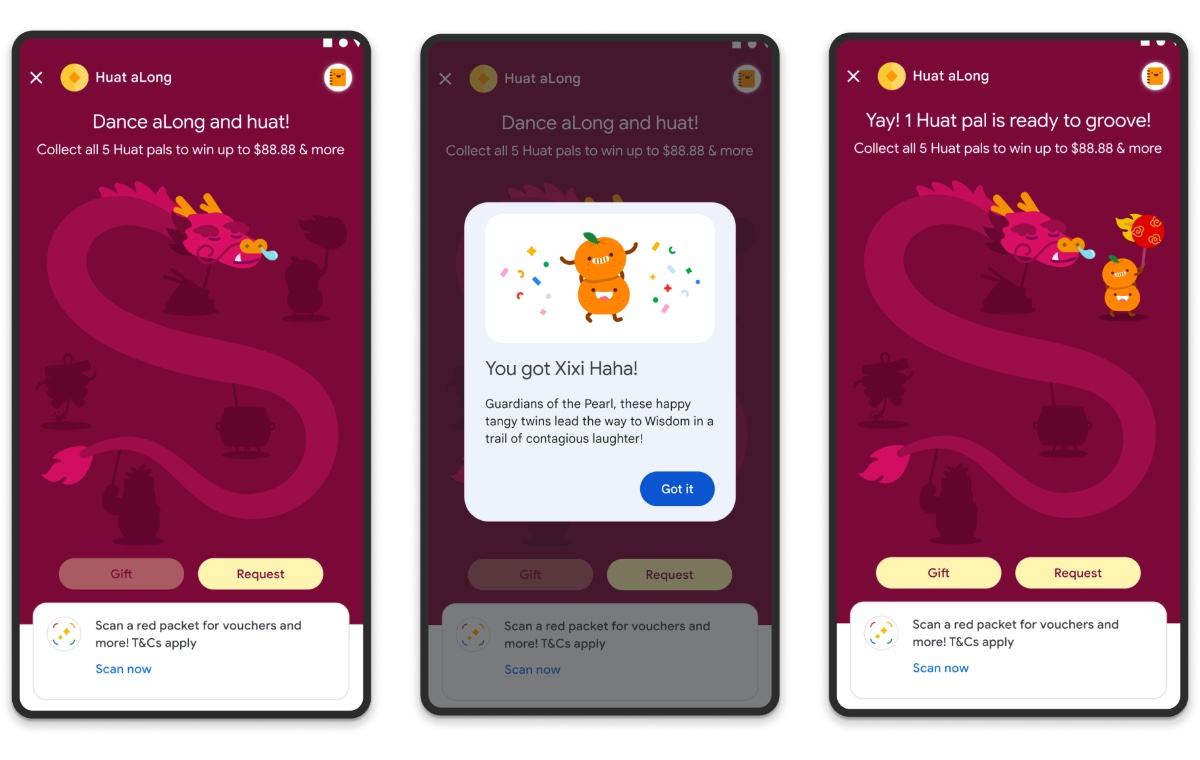

This year, 2024, GPay has once again come back with Huat Pals, also renamed Huat Along. Get it? The event will take place from 6 Feb to 18 Feb 2024

With the social aspect of CNY back after the Covid years previously, there are some additional items that give you more opportunities to get more goodies. That said, it also means you have to make more effort to get more once again but it never fails to attract a big bunch of folks

Five new Huat Pals — Xixi Haha, Ah Bong, Macho Meow, Hop Pop and Souper Loong – will be added to welcome the Year of the Dragon. Collect a Huat Pal each time you complete any of the following actions on Google Pay.

Join the trading telegram group here: Join the new trading telegram group to trade and share your referral link: https://t.me/huatpalstrading

Step number one: You need to set up and download Google Pay for a start.

You can sign up for a new account here: g.co/payinvite/t74cf8f from your mobile app or use this link here at Download Google Pay you’ll earn $3 when you opt-in to Google Pay offers and rewards and make your first payment (min. $10)! Download the app and use my referral code t74cf8f to get started.

Next Step number two: You will need to understand how the mechanics work.

Now, different things tick with different folks so do what comforts you. Do take this article with a pinch of salt and a guide. If up to $88 worth of cash is not worth your effort then do proceed to do what comforts you and gets you more for your time. It should not make you anxious and keep your mind calm.

Once you have collected all 5 Pals you will win one of the following (It is random so please don’t over-react if you don’t get any):

- Scratch card worth up to S$88.88; or

- Google Pixel devices – Pixel P8 Pro worth $1,549

- Google Pixel devices – Pixel P8 worth $1,099

- Google Pixel devices – Pixel Buds Pro worth $299

- Google Pixel devices – Pixel Buds A-Series worth $149

As usual, gamification will attract throngs of people and only one rare item.

Once again, this game aims to have as much activity as possible. It isn’t a game of fastest fingers first so you kind of need to strategize and spend money in general.

Step number 3: Available and activity required to get goodies (This year there are more options) but also slightly more difficult to get it.

These are the same as what is in your app in the same order so GPay has nicely done it in a way that you can work on the tasks as if it is a list of times to fulfil daily.

A. PAYNOW to merchants (You can do it 1 time daily)

You need to spend a minimum of $5 to make this eligible. A small tip, any payment, or PayNow to business would work. In previous years, the reset timing was 10am. Not sure if that would be the same this time around. From what I understand, topping up to CPF, the shopee account works thus far.

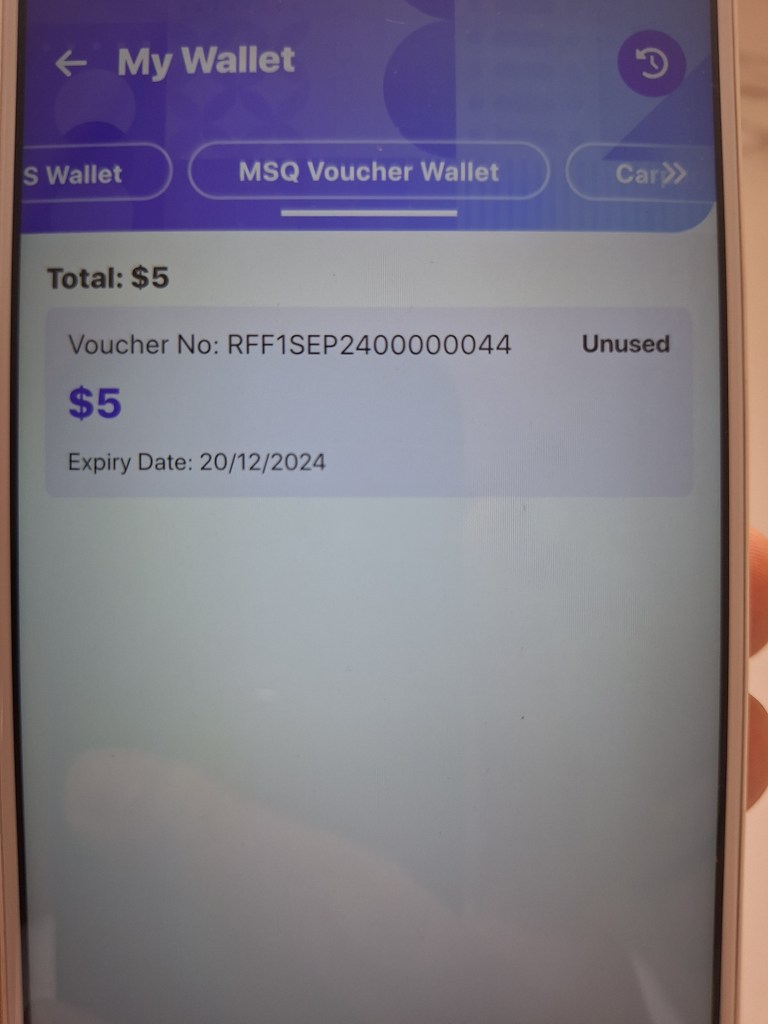

If you do not have a YouTrip account. You can sign up here: via my referral link

You can get $5 when you top up your YouTrip card.

B. Make a FavePay transaction (You can do it 1 time daily)

In all honesty, this is pretty tough and you need to spend a minimum of $5 as well.

C. UBuy movie tickets on Google Pay(You can do it 1 time daily)

I’m not tot sure about you. I’ve have not been to the cinema in years.

D. Send money to a friend (You can do it 1 time daily)

Yup. As simple as it gets. You send money to a friend for $10 and the recipient must be a Google Pay user as well) I believe this is a new rule now.

E. Gift a goody to your friend (You can do it 5 times daily)

Finally, the last daily activity is to give your extra goodies to another friend (Aka trade) Those who know where to trade will know. It takes a bit of effort but yeah just enjoy the process. Join the new trading telegram group to trade and share your referral link: https://t.me/huatpalstrading

Step number 4: Additional game or photo taking or Huat Quiz daily

So random quizzes or daily requests such as taking photos of items will get you additional goodies and these come in random. These are known as Huat Scanner and Huat Quizzes. (It is a QR scanner and answering quizzes) My thoughts are similar to how Google search functions. The more you engage in the activity, the more these requests will pop up. Though random, there is some AI to it (i.e. robots related) We will not know but like any other games you played before, the more active you are, the more likely you are going to level up and do better. One additional aspect is a candy crush-style game in which one needs to score 450 or higher.

Whether it gets difficult, I’m not sure but let’s just have fun.

Side note, thank you google for the media announcement but perhaps you can send it to me earlier than the next event because my day starts, I have a day job and creating all these takes time and effort. You are always welcome to reach out to me to have a chat via my email. I’m happy to explore. Cheers anyway for providing media items so that I do not have to source for those on my own.

Conclusion

I can’t tell anyone this is worth your time to do all these because we have different values in terms of time and what it gives back to you. However, during the promotion period, there will be changes as Google work on bugs and several things to make sure that they can be as fair as possible to everyone. May luck be with you. Remember two things: The more you want something, the less it will come to you. (Because of the state of the mind) & This should not shun you away from doing the proper and real things in life that matters to you. (Be real, be yourself)

If you like what I am sharing or if it resonates with you, do use my referral codes for other services at Referral and Recommendations

These pictures were taken off the Google Media Kit for reference.

To Huat A Long Year and a better 2024 ahead. Cheers.

Remember to trade here: https://t.me/huatpalstrading