Whenever we touch on the topic of owning cars in Singapore, there will always be a ruckus. The ambitious demands of ourselves would deem that we wish to own a car, a branded German Luxury for most. However, as much reasoning that we give, owning a car here is as good a depreciating asset or in more negative context, a liability. Owning a car isn’t exactly rocket science but there are some things to take note and the extra costs that comes in regularly. A piece of transportation that brings you from A to B, that’s something everyone appreciates if you have the luxury to do so.

Own or Grab?

Hands down, taking grab rides, gojek or comfort taxis wins owning a private car. It gives one the luxury of leaving home at any time and going anywhere without any restriction or so to say no stress. That comes with a price like any other thing.

Perhaps for a start, what are the tax and pricing related to car?

1) Open Market Value (OMV)

OMV is the price paid or payable when a vehicle is imported in Singapore. The Customs assesses the price and is inclusive of purchase price, freight, insurance and all charges. Different cars have different OMV.

2) Additional Registration Fee (ARF)

ARF is the tax payable when you register a vehicle. ARF is based on a percentage of the OMV. This is just another layer of tax on top of all other fees and taxes.

3) Excise Duty & GST

You need to pay customers excise duty to import and register a car and motorcycle or scooter. There is also a 7% GST payable to Singapore Customs based on the total cost of importing the vehicle.

4) Certificate of Entitlement (COE)

All vehicle in Singapore will require a COE. In order to register your vehicle, you need to place a bid for a COE in the different category. Once you have a successful bid, you get to own a vehicle to use on the road for a maximum period of 10 years. This is the upfront costs apart from all the taxes and fees.

5) Finally, the margins (The P&L)

After paying for all the taxes and fees, the companies who sell these cars need to cover their overheads, costs and make a margin on it.

The other costs

Now that you have paid for the car and you manage to drive it home. No, wait. Before you do that, you need to have a valid driving license.

Driving License

This costs roughly from $800 to $3000 depending on how good of a driver you are and if you take a private lessons or a driving school. The school definitely provides you with an all encompassing structured lesson but it also costs more. If you fail to get your driving license on the first try. That means more practical lessons and more cost. The upside to this is that, there is no expiry once you obtained your driving license until you are deemed too old. You will be required to complete a renewal test to ensure that you are fit to drive.

Car Insurance

In order to drive on the roads, you need to have a valid car insurance. The cost of insurance is renewed annually and depends on your age and type of car you own. You can have a comprehensive plan or a basic plan but in my opinion, you just need to go for the most comprehensive plan to get yourself covered.

Road Tax

Once you have paid for your car insurance, you will need to pay for your road tax. How is your road tax calculated?

a. Engine Capacity – The larger your engine’s capacity, the higher the amount of road tax (Payable 6 months or 12 months)

b. Age of your vehicle – Vehicles that are more than 10 years incur surcharge of 10-50% on top of the standard road tax. (For cars renewing beyond the initial 10 years of COE)

If you forget to pay your road tax, you will be liable for late payment and also for infringement since you are not allowed on the road. Yikes, more bills.

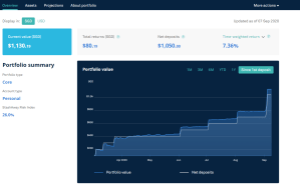

Car Loan

At the start of the article, I discussed about the price of buying a car. You can now loan up to 60% of the total cost of the sale of the car. Depending on the interest rate you can get, (Maybe around 1.88% p.a. at this point) that will be the additional interest payable on your loan amount.

Not too sure about you but it seems like the costs are piling up even before driving it on the roads.

The maintenance costs

It does seems like it doesn’t make sense to own a car anymore now but I still need to add on the maintenance cost during the 10 year life of owning the car.

Maintenance/Servicing

The initial 3 to 5 years should be an added benefit that your dealer will throw in when you buy that car. But take note that this is just purely servicing, meaning engine oil change and those point checks and tyre rotation. Any wear and tear are still liable to be charged at their retail price.

Typical servicing starts around the 1km, 5km, 10km mark or around 3-5 months depending on which comes earlier. I mean, if the car is new there wouldn’t be an issue. But if you don’t bring your car back to the dealer then the warranty that they gave you would be voided.

Inspection check

During the first 3 year of owning your car, before you renew your road tax, you do not need to bring your car to a registered inspection company such as VICOM or STA. After the third year, you have to do so to ensure that you do not change certain aspects of your car when you drive on the roads. It is a small cost but it does take some time to do so. After the initial 3 years, you have to go for an inspection once every 2 years until your 10 year mark is up. For cars more than 10 years, you have to do so annually.

Car Battery Change

If you do not own an electric car, you need to change your car battery 1.5 – 2 years regularly. Depending on what kind of car you drive, the number of batteries and type will also differ in price.

Wear and Tear/ Repairs

Any wear and tear (e.g. brake pads, windscreen wipers, tyre balding, rim change, air compressors, solenoid, repairs and more) will incur cost. After all, you need to make sure your car lasts for as long as it can given how expensive they are. Your tyres need to change every 3-5 years depending on how you drive your car and there may be small damages or even faulty electronics due to wear and tear. Also, our climate is pretty warm and heat will wear most stuff out when exposed over time.

Parking and Fines

Anywhere you stop your car, you need to enter a carpark. Parking your cars comes with a cost. You can’t just stop anywhere you want. If you get a parking ticket, that amount will pay for your 1 month’s parking budget.

Take note of red light and speeding cameras. Any breaches will set you back a few hundred dollars with demerit points. In the worst case scenario, you may be charged and your driving license taken away.

Electronic Road Pricing (ERP) and New Changes

Paying tolls have never been easier. (Sarcasm) Going through expressways and roads during peak period will set you back a few bucks per day when you drive through these to ease traffic flow. These will be replaced by a satellite distance-based ERP system in the near future.

Fuel Costs

Finally, you need fuel to run your vehicle. Basically, everyone is a price taker. You can’t not fuel up your car. Not having fuel in your car will do your vehicle more harm than good. After all, you are supposed to own some form of flexibility with a car.

Conclusion

Don’t feel that owning a car is beyond your reach now. There are different ways to do so. To always weigh the pros and cons about owning a vehicle, you will find the answer clearly but we still see a lot of vehicles on the roads. This part of our brain is unexplainable, the comfort and flexibility of owning a car outweighs all that reasoning. I have also read about the other options to owning a car but it really depends on individuals.

a. Lease (Instead of owning it, you pay a fixed cost per month for leasing the car)

b. Drive for a private hire (You get to moonlight during your free time but perhaps not so ideal during this covid-19 situation)

c. Own a car and lease it out/rent it via apps. This will cut your cost in owning a car

d. Take the public transport and Grab/Gojek. Times are different now, we are not at the mercy of Nazi Taxi Drivers.

Personally, I just am thankful during times when it rains. I get the comfort of going to somewhere at whichever time I wish without getting drenched. There isn’t any worries of price surge or cancellation. That said.

Disclaimer

This is not a sponsored post and purely my own opinion that I am writing about in my thoughts. If you like what you are seeing, do remember to check they out and do your diligence. Don’t be too fixated with what is the best.

If you like what I am sharing or if it resonates with you, do use my referral codes for other services and products here at https://atomic-temporary-178675883.wpcomstaging.com/contact/ for the services.

Images seen in this article were take off the relevant websites for illustration purposes only.