Deductibles on MA – CPF

Happy Friday. My mood is getting better by the day because I have clarity over what I have to do with my life in the next few weeks. I believe everyone has received their CPF interests. Some people have a lot more while others are just started out. I understand human psychology makes you a bit more envious than others. Not many people can shut the noise out. Here’s what I am going to do. You need to learn to cut it out because you are you. Not to worry, we must believe that we can do a lot more.

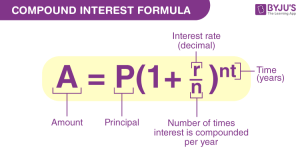

Today’s focus will be on deductibles for your CPF. This is not for everyone but it is good to know. It may not apply to you today but it will some day so be in the know. By now, if you are looking through tax deductibles via CPF, you would have known that 1st Jan 2024 is a great time to receive interest in your CPF account. Slowly but surely, your CPF will compound. In my very early days of financial blog, I talked about the power of compound. Do refer to that and you can see how powerful it is and time flies very quickly.

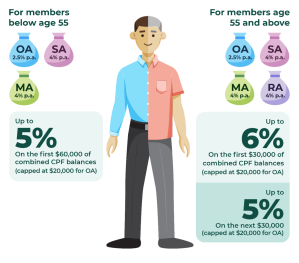

CPF is divided into OA, SA, and MA and apportioned according to your age. If you have planned it well by some time, you would have maxed out FRS in SA and the cap at MA. The interest portion that you received will not flow into your MA but goes to the other accounts and if you hit your SA, then it goes only to your OA. That means that by contributing cash to your MA or what we know as a top-up. That helps in your tax deduction for the year.

Usual years – likely due to normal inflation rates, the top as projected is about 2 to 2.5k every year. As of 2024, one can top up to 3k in the MA. That helps with tax deductions.

Just a disclaimer that everyone’s situation is different so you have to consider some factors:

- Do you have a mortgage that you need to pay from your OA?

- Did you use any CPF monies for T-bills. If you need cash flow, then you have to plan it out.

- Do you require liquidity? CPF Is an irreversible process until you reach the statutory age of 55 or longer.

- If this does not apply to you. Just be in the know, let it be a motivation.

Disclaimer

If you like what you are seeing, do remember to check them out and do your diligence. There is no one-size-fits-all investment strategy or general rule for your every life. Join my telegram group to find out more about deals and join the community to connect for ideas: Life Journey Telegram

If you like what I am sharing or if it resonates with you, do use my referral codes here at Referral Services

Hi there.

A well written piece.

The CPF is a unique savings scheme where its compulsory yet does not allow people to just dump their money into it.

It gives a reasonably decent and steady but not market leading interest rate. Because of this, the benefits of the CPF are not immediately apparent but will only be appreciated years later, when one is in their 50s and older.

At 62, I am now in that age group that appreciates the benefits of having a portion of our savings tucked away in the CPF for a long time to compound and grow.

I have hit $2M savings in my CPF savings this Jan 2024.

LikeLike