After a short break and some self-sustained recovery, I think it is time to get back to updating the portfolios. During this period when I was down, I was not really monitoring the markets. In fact, I set my RSP up over these 8 – 9 months that I was missing in action. Partly, it was due to work and also self-discovery wellness. In my last post, I discussed being away and not being able to do anything to your portfolio and again I was away. I find that robots suit my style of investing. In good times and in bad times because I am just not in the right frame of mind to manage my portfolio. Not anyone can just buy in when the market is down. You need to understand your own investment appetite.

Thank you to those who have used my referral code. If you wish to venture out and build your financial goals, please do visit my referral code page thank you in advance.

Portfolio Summary

The whole portfolio has taken a big hit this year in 2022 and there’s nothing much to shout about but I look at it as long-term growth. I am quite positive about US equities. My Ultra cash portfolio isn’t doing too great. In hindsight, I repeat that I do regret my decision because I thought I can take my liquidity out within 3 months but no. Now, I have to do it at a loss. This really sucks because Endowus did a boo-boo by saying that it can be a short-term cash-fund holding. Now, I am becoming a long-term investor and had to find cash for my large purchases that were coming up. I am still miffed about it but I’m not taking it out at a loss. It doesn’t mean that Fixed Income will stay down all the time.

Like any other period, I trust Endowus and I would actually recommend them to anyone I know for the investment concept. (Maybe not the cash solutions) I know that my investments will be safe with them. I’m happy with them for the investment part of things. I also learned that different people/companies have different expertise.

Lower Investment amount

Whatever it is, they have been quite reasonable about everything. Another plus point is that they have also given me a lot of comfort in the way they allow investors to reduce their initial investing sum. A minimum sum should not be the way to invest. Overall, I feel that I take more pride in knowing who is holding my money and how they do it.

Lowering the bar also allows people who are younger to start early in this long-term process. The other point is what many people are talking about which is the fees. They are probably the only ones in the market to rebate trailer fees. I like that bold big move as compared to the other advisors. I will slowly shift my funds over to them. Everyone is different so, you have to try them out first before you decide.

There’s something else which I like about them and that is how they use the power of retail investors to put money into institutional class funds. These funds are accessible only to people with the money and volume to purchase. Yet, they are now available to retail investors.

Total Portfolio

I decided to scrap away all those segmented accounts with different goals and look at the portfolio as a whole instead.

I hope can recover some of the losses but as a function of market-related money market funds, I think it will take longer than i expect.

I hope that I will be able to add more funds to the S&P 500 if it dips over the next few months.

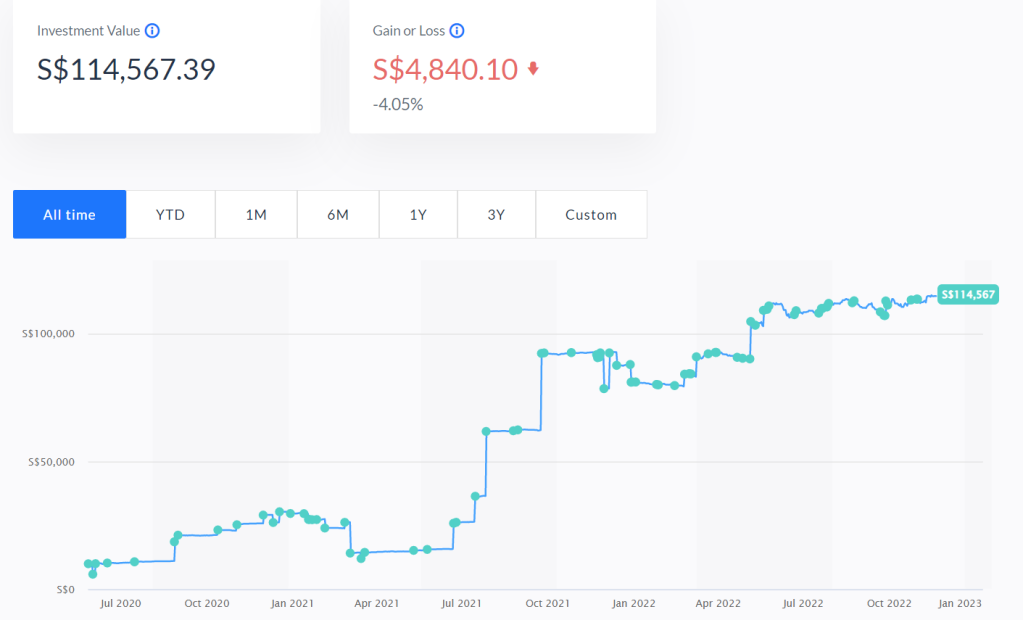

As you can see, the all-time record is that I am now down -4%, which is rather disappointing considering that I have a relatively balanced portfolio. The bulk of the unrealised loss is actually from my cash funds. (Sad to say that FI instruments are still doing that badly) which is why it is true that no one has the crystal ball and we have to diversify. If you look at YTD performance, it is down -6%, which is rather in line with the current markets but I do expect better considering I had a good entry-level during the start of the covid investing when the markets were pushed down in a synthetic way in 2020.

I’m still looking forward to the day when S&P 500 goes up the roof and I see my portfolio doubling.

The reason for Endowus

Like a broken recorder, the pros once more:

- Endowus is the first and only robo-advisor to be approved by the CPF board.

- 100% trailer fees back to the consumer, not the fund management fee. This is really one of a kind I’ve seen so far.

- They do have a decent team who makes sense when introducing their platform in my personal opinion.

- I believe all retail investors should try them out because of how they are trying to disrupt investing and make investing work for everyone.

Thank you all in advance for using my referral code.

The last point is to do your own diligence. What works for me may not work for you. Investing in traditional portfolios is about risk management. My Cash Funds are bleeding. That was a super bad call by Endowus.

Disclaimer

If you decide to sign up with Endowus, do remember to use my referral code: https://endowus.com/invite?code=EDZ8M

If you like what I am sharing or if it resonates with you, do use my referral codes for other services at Referral and Recommendations

These pictures were taken off the Endowus website for reference.