A very late review of February 2021 – I took some time out. About three months just to make things a bit better for myself. It is time for the monthly review again. In my last post, I discussed about being away and not being able to do anything to your portfolio. While taking care of my own well-being, I didn’t do much nor did I monitor my portfolio. The only additional thing that I did was that when the Ukraine Russia War started and markets dropped. I added some funds to the Lion Fund that tracks the S&P 500. Again, it is not for everyone. Not anyone can just buy in when the market is down. It all bow down to how you invest.

Portfolio Summary

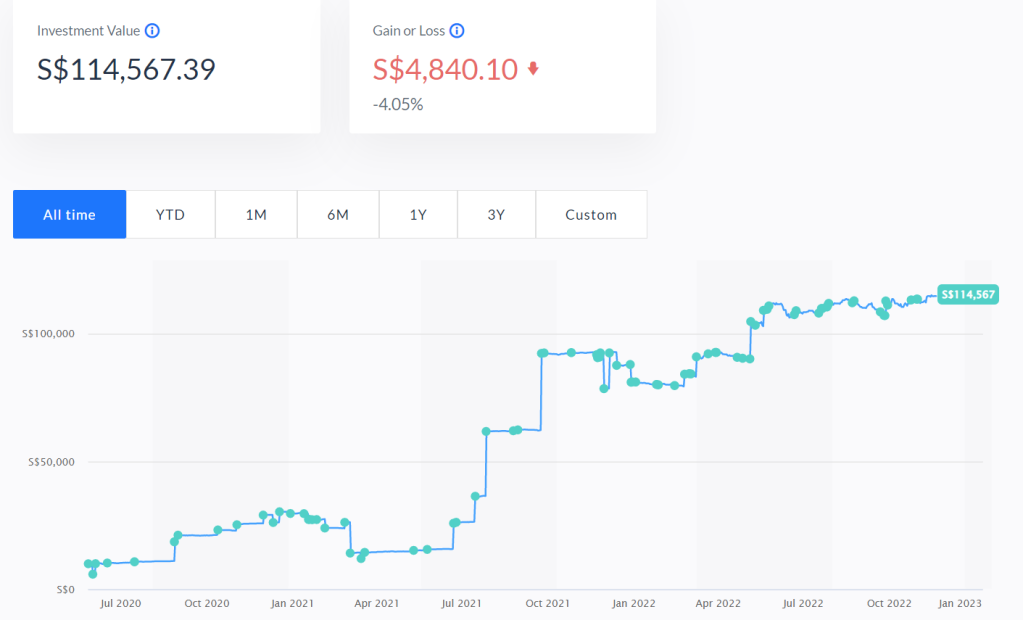

The whole portfolio seem to rock in 2022 but I look at it as a long term growth. I am quite positive on US equities throughout the rest of 2023-2024 for some reason despite the constant word around hyperinflation news. My cash portfolio isn’t doing too great. On hindsight, I repeat that I do regret my decision because I thought I can take my liquidity out within 3 months but no. Now, i have to do it at a loss instead of waiting it out but then again, the cash fund is now losing $1000 in totality. Oh well, we have to take charge of our own decisions. I was greedy for yields and yet not willing to hold for a longer period.

Like any other month, I trust Endowus and I would actually recommend them to anyone I know. I know that my investments will be safe with them. I also read in their newsletter that traditional banks and investing firms are starting to put in monies in the company as part of the drive to stay relevant. The paradigm shift is happening faster than expected. Except the fact for cash funds, I’m still quite happy with them.

Lower Investment amount

Whatever it is, they have been quite reasonable about everything. Another plus point is that they have also given me a lot of comfort in the way they allow investors to reduce their initial investing sum. Minimum sum should not be the way to investing. Overall, I feel that I take more pride in knowing who is holding my money and how they do it.

Lowering the bar also allows people who are younger to start early in this long-term process. The other point is what many people are talking about which is the fees. They are probably the only one in the market to rebate trailer fees. I like that bold big move as compared to the other advisors. I will slowly shift my funds over to them. Everyone is different so, you have to try them out first before you decide.

There’s something else which I like about them and that is how they use the power of retail investors to put money into institutional class funds. These funds are accessible only to people with the money and volume to purchase. Yet, they are now available to retail investors.

Cash Fund Ultra Portfolio

I started the ultra portfolio since July 2021 which claims to be around 1.9-2.1% (this went downwards) because I can’t find anything that yields more than 1% interests.

I hope can recover some of the losses but as a function of market related money market funds, I think it will take some time.

Further, I added another 30k into the portfolio as cash injection to yield higher interests but it has been negative since day one and still in negative territory so let’s wait and see how things pan out. Negative $1000++. What the heck! For Cash funds!

ESG Portfolio

I started this ESG Portfolio during March 2021 and I have some high hopes for this fund to do pretty well. This segment would serve me well for a long term portfolio because I do see the value in investing in sustainable companies an practices. After all, we are trying to make a difference for our little ones. Performance has been stellar. It has pulled back and dropped 0.92% Finally added $2500 when there was a pullback. This screenshot was taken early part of March, showing the volatility.

The allocation is a 80%/20% Equity/Bond portfolio allocation so there will be more movement on the equity side. This is long term so, just leave it in there. You do good and it brings you sustainable returns. It is for the future and the next generation. I can’t explain more. Maybe it is time for more deployment of cash.

SRS Portfolio

Overall, portfolio is still up +17% since May 2020 in SGD. As usual, in USD terms, due to no FX impact as the portfolio is USD ETFs, the performance will definitely be better especially when USD becomes stronger. Of course, the reference will be SGD since I use SGD. This is the SRS/Cash portfolio which consists of my favourite Dimension Funds in a 40% bonds/60% equity.

Overall from May 2020 to 15 March 2022, it is a +17.05% increase in absolute terms – quite okay. This is for the long run. I’m just going to keep it simple to report it overall as I have less time on my hand these days. But do try it out and put out your own performance and tell everyone about the experience. Unless, you nitpick aggressively – I think you will be fine. All time performance it has dropped 10%, that’s quite significant but everything just dipped.

On the YTD front, I’m looking at down $500+ haha.

CPF Portfolio

For the CPF portfolio, it is looking at +9.72% since inception in May 2020. That’s a huge drop of almost 10%. This portfolio is being beaten down now. But not for long.

On the YTD front, it has dropped to -$480+++ haha

Fund Smart Portfolio

I started this semi medium term Fund Smart portfolio this month in May 2021. I tried to build a balance portfolio. I’m not exactly sure but I will go in via RSP monthly as I wasn’t sure but I do want to deploy some of my cash. All time absolute return is -8.62%. haha. This is done monthly on RSP until 2021. It still continues to be underwater so I have reviewed and will continue to DCA in when markets have dipped.

Overall: 52% Equity and 48% Fixed Income

a. 15% in Multi Asset Fund (1 Fund)

b. 45% in Equity Funds (2 Funds)

i. Focus into China Play [10%]

ii. Global equity with dividend accumulation (Re-invest) [20%]

iii. Small Cap equity play (For the Alpha) [15%]

c. 40% in Bond Funds (3 Funds)

i. Climate Bond Fund Play [20%]

ii. Core Fixed Income Play [20%]

Retirement Portfolio 1

So last month, I got down into building a portfolio of unallocated funds to the institution Pimco GIS Income Fund. 0.55% will be the fees annually so that’s going to be start of the accumulation of the coupons from the funds. We are down 5.40% haha.

I deployed some cash on some portfolios as I can’t get good yields.

Retirement Portfolio 2

Yet again, I put in 2 tranches of S$5k into the Lion Global Infinity 500. At one point it was close to 6-7% down and today is is up 3%. Real volatility guys. Be prepared.

The reason for Endowus

Like a broken recorder, the pros once more:

- Endowus is the first and only robo-advisor to be approved by the CPF board.

- 100% trailer fees back to the consumer, not the fund management fee. This is really one of a kind I’ve seen so far.

- They do have a decent team who makes sense when introducing their platform in my personal opinion.

- I believe all retail investor should try them out because of how they are trying to disrupt investing and make investing work for everyone.

Thank you all in advance for using my referral code.

Last point is to do your own diligence. What works for me may not work for you. Investing in traditional portfolios is about risk management. My Cash Funds are bleeding. That was a super bad call by Endowus.

Disclaimer

If you decide to sign up with Endowus, do remember to use my referral code: https://endowus.com/invite?code=EDZ8M

If you like what I am sharing or if it resonates with you, do use my referral codes for other services at Referral and Recommendations

These pictures were taken off Endowus website for reference.