Portfolios are taking a hit over the last month and still going through the same in October. I am still trying to find time, balance to write about stuff, blog and find out more about personal finance interesting topics.

Though there isn’t anything exciting here this month, this helps me to keep track of my investments on a regular basis. AutoWealth’s concept and the unique selling point as compared to other robo advisors are different. I like to think of it as these are ETF related portfolios. AutoWealth (AW) is rather low profile. I also received a notification that their app version is ready. Perfect timing actually. Here to the portfolio performance.

Why Autowealth?

I’m just to just reminding myself why was I a friend of Autowealth every month. Trying out a Robo advisor that uses ETF instead of funds and diversifying my investment assets through different companies. The reason is to measure performance as well as the experience.

Instead of using investment Funds, AW uses ETFs to build a portfolio instead of funds. This is similar to StashAway. To me both ETFs and Funds work as long as fees stay low. Of course trusting the company is another factor.

I was kind of expecting a rough market in 2021 but it has proven otherwise with the exception of Sep and Oct. I have read countless reports that the China Evergrande and Fantasia debt issue will come into play in the US soon. To be honest, I am a little concerned but investing is all about avoiding the noise. So far the markets have been stable and more sustainable in the first half and picked up in the second half of 2021 and I say it is a topsy turvy last Quarter for 2021.

Every market goes through their cycle of peaks and troughs. Every time market drops off, you just have to be consistent (Taking away your emotions) and just pick some more investments. As for the rest, let the robots do the work on keeping allocations and balancing. As long as fees remains low, the portfolio will grow faster over time and over a longer period.

So far, my long term goals remains the same – A steady pace.

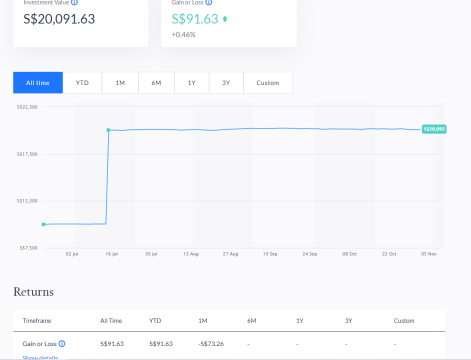

Performance – Sep 2021

My investment horizon would be estimated to be 15-20 years for this portfolio. This is a portfolio which is set at 40% equities and 60% bonds. (No Change)

The allocation will be diversified globally. What i really like on the interface is that i can switch between the SGD and USD currency performance portfolio as well as the impact on USD SGD forex on performance. The comparison has to stay consistent, otherwise it isn’t a fair comparison.

Overall, since funding to date (in SGD currency) performance is +13.22% in Simple Returns and I am okay with this. (compared to Aug 2021, month-on-month it is down about -2.60%) The impact of USD on SGD is about -1.09% and by referencing the portfolio in USD, simple returns would be at +14.09%. This decreased by -4.1% compared with Aug 2021. Tough ride ahead i guess.

Comparing YTD 2021 performance

Looking into the details if I were to look at the portfolio value at S$5334 (end Dec 2020) versus today at S$5661. Some simple and manual YTD calculations below:

YTD Performance[(S$5661-S$5334)/S$5334] x 100% = +6.13% (YTD 1 Oct 2021 and -3.30% as compared to Aug 2021).

Note that the December 2020 numbers is not what i used for calculation but I have been using this $5334 for Dec year end portfolio total so this is the consistency in calculating.

I do have an issue now though. Originally, I wish to add and deploy more funds but I can’t seem to enter at this opportunity. I guess it is a good problem but I don’t wish to hold on too much cash due to the current low interest environment for short term cash.

Over here, I just put out a performance breakdown summary that was available in the website.

Performing assets include US Equities, Europe Equities, Asia Pacific Equities, EM Equities and Dividends collected.

Non-performing assets are on the minority side with US Government bonds and International Government bonds. The loss is not great but it is part of the reason why I left it to them to do the balancing act after determining the asset allocation.

Disclaimer

This is not a sponsored post. This is purely my own opinion after using their service and/or products. If you like what you are seeing, do remember to check they out and do your diligence. There is no one size fits all investment strategy.

If you like what I am sharing or if it resonates with you, do use my referral codes here at Referral and Recommendations

The pictures were taken from Auto Wealth website for this article. If you need a referral code, drop me a message and you can indicate my full name during registration. From there, both of us will get $20 each to supplement the fees.