Here we go, the second half of 2021 has arrived and it wasn’t too long before we had resolutions and new ideals. There’s only 5 months left for us to actually do anything to plug the gap. For those who actively review their goals and are on par or exceeding it. Keep on pushing, make it count. At the same time, it does seems like it has also passed rather quickly.

StashAway has been rather stagnant but considering the environment, I think it is holding out well. Then again, it is about comparison. If I compare it with my core Robo then it seem to be a tad shy from the performance. Then, they decided with an ERAA approach that has been rather active. Only time will tell if their algorithm makes the right choice and if there is some human involved, I hope it is only minimal.

Repeating to myself that if Mr Market decides to go either way, it would matter that much to me. Why is that so? If Mr Market drops, then I will add on more to the portfolios. If you have not taken the first step, action early so that you can start doing this early and learn from any mistakes along the way. By now, I would have decide on the main Robo to stake my money with. SA is not quite the one but let’s see how it goes. The competition remains strong.

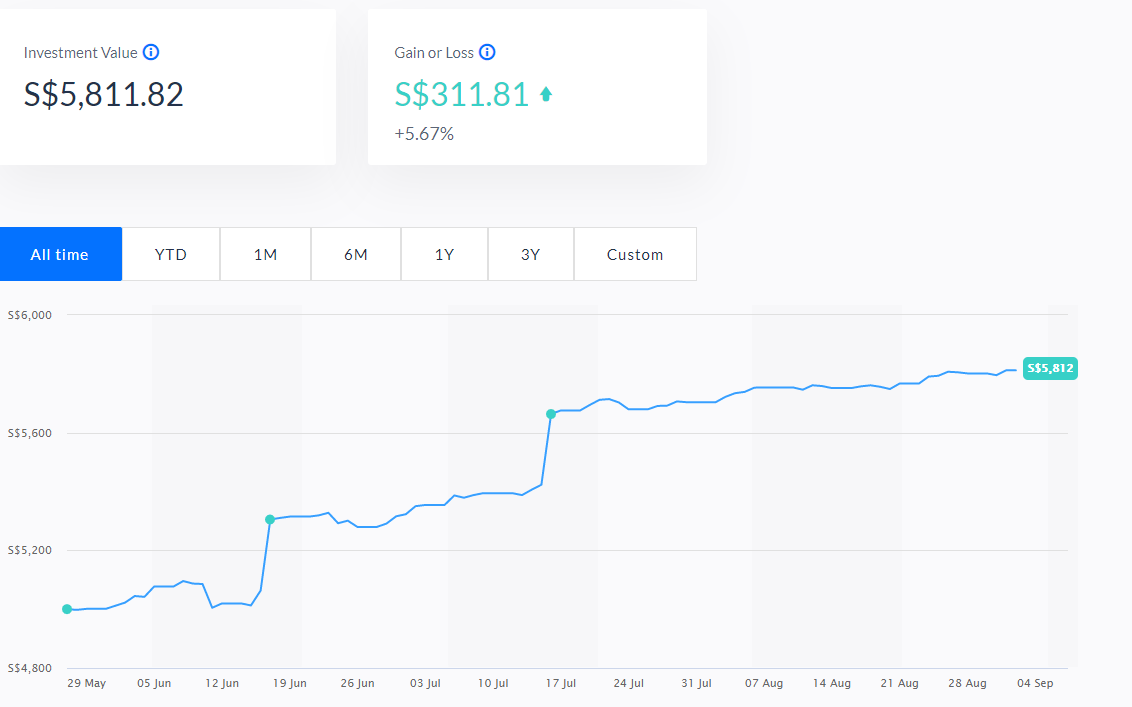

Retirement Portfolio A (risk-14%)

My longest term portfolio for retirement. A little off on the performance level. I could have done a lot better but I shall not look back and will pop in a little more when i contribute to my SRS account. The SRS account since first day deposit is currently at +3.95% as on 4 Aug 2021 (Time-weighted return). Oh well. Performance wise, I think i is okay and also this is a super long term portfolio – I would say close to 25 years horizon so I’ll just leave it there.

In USD performance, that’s about +6.90% YTD (Time-weighted return). That’s quite a bit of FX i am losing out here. It dropped a further 0.8% from last month and 0.6% from the previous month. Then again, I wouldn’t sweat on the exchange rates since I am going to stay invested and into these portfolios. They are just a mean of reference as I look back at the performance. So, still high risk high returns? I think it’s more like, higher risk commensurate the higher returns but there is no guarantee.

Education Portfolio B (risk-16%)

This portfolio B is set out to be on a 15-18 year investment horizon. It is at +8.72% YTD on 4 Aug 2021 and It’s steady. It’s the same as the last time i measured during Dec 2020. I have been averaging in whenever there are market dips. The risk index is at 16% and I will adjust those risk levels as and when I feel that there is a risk on or off. For just a 2% risk increase, I see a better performance already. This month versus the last was a -0.6% drop.

In USD, I’m looking at double digits +12.09% (Time-weighted returns). Again on the Forex rate as reference. This has dropped almost 1% month on month for 2 consecutive months.

Education Portfolio C (risk-20%)

For this portfolio, I look at this at shorter horizon of 12-15 years so I feel that I need to take on some risk to achieve my goals. This SA risk index is currently at 20% and will take on to be one of my riskiest portfolio. Return is at +15.59% YTD (Time-weighted return) since day one as at 4 Aug 2021 Not much of it has changed or rather it has dropped slightly but this is just a note to self and measure the monthly performance. Over time, more funds will be added to achieve the targeted invested goals. Two consecutive drop in performance for this portfolio.

In USD terms, we are looking at +19.90% (Time-weighted return). Looking great as usual. Although I feel that this isn’t exactly the year to take on higher risk for better returns. This has dropped 1.2% month on month for two consecutive months.

Conclusion

It is now more than one year since I started using StashAway. I still think that it has been a great supplement as a robo advisor. After using a few robo-advisors, I find that SA will play second fiddle to my Endowus Portfolio and true enough that fits exactly into how I plan it to be.

StashAway does have their own advantages. They do hedge their portfolios against huge crashes and take a stand on some positions which I do like because a lot asset managers don’t and even though they talk big about macro. The gold move was bold but it protects the portfolio. Again, Rome wasn’t built in a day so I guess you need to safeguard some of your monies to future proof it.

Recently, there were even more adjustments to reduce USD equities allocation all together. I’m not sure if this is an ingenious move that will reap returns in the future but it is take a small hit at the moment. I do hope there isn’t too much of a human factor in these decision.

To find out more about the pros and cons of using StashAway, do refer to my previous posts.

To sign up or try out Stash Away, visit the website and use my referral code at Stash Away Referral

We’ll both get up to $10,000 SGD managed for free for 6 months which is a good deal.

Disclaimer

If you like what I am sharing or if it resonates with you, do use my referral codes for other services at Referral and Recommendations

The pictures were taken from the Stash Away website for this article.