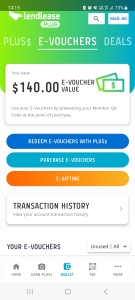

After all that hype and pretty good promotion AngPow vouchers for Lendlease Malls. I must say Capitastar pales in comparison. This is another easty$5 voucher from the CapitaLand app to get. It is little wonder that they are not even too concerned with the fact that their properties are located in areas that are pretty prime and have relatively decent or good location value.

If you have not heard about the Lendlease promotion shopping app. Read my article here: Lendlease $20 free money. Hopefully you will still be in time for the promotion which is limited to 5000 sign ups.

Another easy $5 voucher from Capitaland and additional $5 on spending

Well, better than nothing. The initial quote is to go to the app click on profile on the top left, followed by Rewards for the code “LNY10OFF’

1. The initial $5 e-Capitastar voucher is only valid for 10 days and for the 1st 5,000 redemptions

Note that only 1 redemption per Eligible Shopper during the promotion period

2. The next 5 comes when you spend $100 at participating Capitamalls and for the 1st 500 redemptions per participating mall

Note that 1 redemption per Eligible Shopper, per mall, per day of the Promotion Period

Not fantastic but yeah, save while you can. If you do not have a Capitastar Shopping App, then you probably need to get one first in order to get those deals.

There’s no refer programme at the moment so probably get the one from the official app for a $5 sign up bonus by Capitastar themselves.

The CapitaStar Rewards Programme

CapitaStar is a card-less Rewards Programme with no membership fee or expiry. They reward you with STAR$® (on top of all other rewards on your everyday spend) when you make purchases at participating retailers across CapitaLand Malls. STAR$® are awarded automatically when receipts uploaded via the CapitaStar App are approved.

The STAR$® accumulated in this programme can be used to exchange for eCapitaVoucher and/or exclusive Deals on the CapitaStar Mobile App.

Note: All purchases (including purchases with eCapitaVoucher as payment mode) made in ION Orchard are not eligible to earn STAR$®

How does CapitaStar work

1) SHOP or SPEND

Shop at any participating CapitaLand Malls (with min $20 spend per receipt) or at Jewel Changi Airport (with min $10 spend per receipt) and retain your receipts to earn STAR$®.

2) EARN

Simply snap your receipt with min S$20 spend and upload via the CapitaStar Mobile App ($1 spent = 5 STAR$®).

Receipts of purchase(s) must be submitted no later than the next day of purchase (11.59pm) to be eligible for STAR$®.

3) REDEEM

Redeem eCapitaVouchers via the CapitaStar Mobile App (5000 STAR$ or 4500 STAR$ for Passion Card Members = $5 eCapitaVoucher). You can also redeem exclusive shopping and dining rewards on the CapitaStar Mobile App to enjoy greater savings!

Disclaimer

If you like what you are seeing, do remember to check them out and do your diligence. There is no one-size-fits-all investment strategy and no one solution to life. Join my telegram group to find out more about deals and join the community to connect for ideas: Life Journey Telegram

If you have not heard about the Lendlease promotion shopping app. Read my article here: Lendlease $20 free money

Use my referral code ‘DZEqaq’ when signing up or click on this link: New Lendlease Sign-up link

If you like what I am sharing or if it resonates with you, do use my referral codes here at Referral Services

Some of the more interesting local context is that Revolut tries hard to bring in new partnerships such as 20% cashback on public transport by using the card and so on. Brands such as Nike.sg, Lazada, Decathlon and iHerb is already on their cashback programme. I find that these cashback returns are pretty decent and you can redirect your funds to purchasing cryptocurrency if you wish to. Otherwise, you can just leave that as cash.

Some of the more interesting local context is that Revolut tries hard to bring in new partnerships such as 20% cashback on public transport by using the card and so on. Brands such as Nike.sg, Lazada, Decathlon and iHerb is already on their cashback programme. I find that these cashback returns are pretty decent and you can redirect your funds to purchasing cryptocurrency if you wish to. Otherwise, you can just leave that as cash.