Understanding the CPF

Whenever or do we ever discuss the CPF system with friends and family. The actual fact is that I never really do unless it is time to do something about it. That involves tax season or even property tax season. I do feel that it is a system that we think we all know but once we delve deeper, there’s always something new to takeaway.

Let us also face it. It is a dry topic and a very long-term one. It tries to mimic a pension fund of some sort with some level of control yet it works differently for different people. I can understand why some people come to dislike the policy but in general, there’s not much hate around it. We also have to be factual that Anti-government does not mean you need to be anti-CPF. Some might differ but I think all tools that bring one to the final goal are the ultimate endpoint.

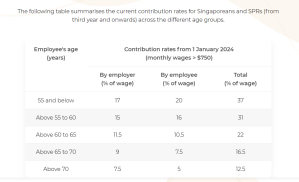

Contribution rates according to age and wages

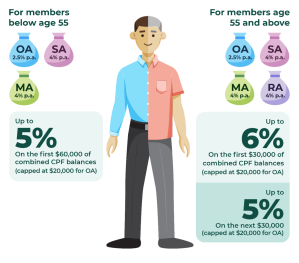

The rules are pretty simple. Understanding that before 55 years of age, all employees have to contribute 20% of their gross salary. Subject to the ordinary wage cap which we have discussed previously.

After 55 years of age, the contribution starts to decrease. This makes sense since the decrease in employer contribution, older employees will become less expensive and it helps to make employment more affordable.

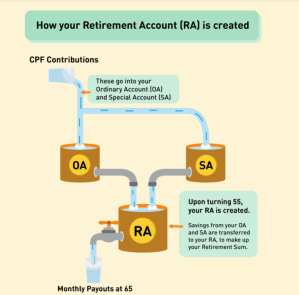

After 55 years of age, the OA and SA will be combined and set aside in one’s RA to safeguard a monthly payout in the later years. This is probably why the contribution rates start to decrease then. Further, with increasing age, the focus will be more on wealth preservation and income that can be utilized. That would be the next reason why the contribution is lesser as time goes by.

Understanding the CPF – Did you know? What contributes to your CPF?

Understanding that CPF system – These mainly include all forms of payments that are paid out to the employee by the employer.

- Basic Wages

- Overtime Wages

- Bonus

- Cash Incentives

- Commissions

- Cash Incentives

Understanding the CPF – Did you know? What does not contribute to your CPF?

- Termination/Retrenchment Benefits

- Reimbursements

- Benefit in kind

Disclaimer

If you like what you are seeing, do remember to check them out and do your diligence. There is no one-size-fits-all investment strategy and no one solution to life. Join my telegram group to find out more about deals and join the community to connect for ideas: Life Journey Telegram

If you like what I am sharing or if it resonates with you, do use my referral codes here at Referral Services