We hear a lot about FinTech funding and block chain technology. Along with Bitcoin, Ethereum or even new funding coins as an alternative way implemented into bank payment systems over the last 3 to 4 years. This is ruling the world today.

It is rather difficult to bring across this concept and idea as it works better in demonstration as compared to talk about it.

What is FinTech?

It is mainly disruptive technology that has the capabilities to replace financial services. It can be in the form of cheaper way or a more convenient way. At the same time, it will proof to be more efficient and safer too.

Just to get yourselves interested on the concept of block chains, do watch this quick video: BLOCKCHAINS

I really like to see, read and hear about Bitcoins in which they are a small subset of the bigger ecosystem and this is a good introduction to start with: BITCOIN

Such block chains systems should be a secure channel as a third party using bitcoin as part of the transaction which in turn can be redeemed back into the real currency thus creating a market and a natural one in doing so.

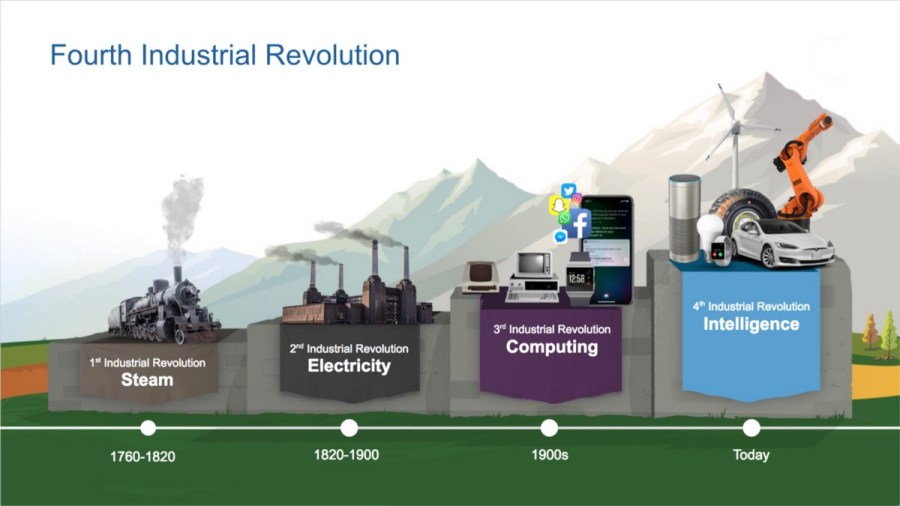

The World Economic Forum 2016 early this year in Davos discussed deeply into the trends and how the world is moving into. In summary, it could possibly be the fourth industrial revolution.

Revolutions are a result of significant changes that destabilizes and question the status quo. Eventually, it pushes change through over time. The first revolution might bring about a new form of problems coming many centuries into the future. (Such as air pollution, breaking the ecosystems, genetics and food production techniques just to name a few)

Source: WEF

Changes

Significant changes brings about many issues such as loss of jobs/income. The non-necessary skills required previously and to reduce amount of time and effort required to get things done. Eventually, new skills and new jobs will eventually be created thus it is important to stay relevant. The loyalty that one pledge to the company are no longer viable. Companies are also faced with the same task of returning ROI on every dollar of shareholders’ money and that in my opinion is vested interests.

a. IOT – Internet of Things

The big subset of block chains in my view is Big Data. That is IOT, Internet of Things combined. With many many different concepts to build a computer server that can maintain and sustain all of this. Many of us know this and that is Cloud computing. In time to come, Superhuman computers may be developed into cybersecurity into a whole new level. (e.g. AI, Artificial Intelligence)

I would believe that Amazon and IBM resources would have the capabilities to bank on such new technology. I do see a lot of the practicality developing into China. A lot of these are going on aggressively but the level of secrecy and confidentiality still plays such a big role as a former communist country. My guess is that China will bring blockchains to a whole new level all together and that would be a footprint into the new world technology.

b. Alternative Financial Solutions

Financial Institutions are not tapping greatly on FinTech to date. Take a look at Nokia today. Sometimes it makes us think about embracing change before it is too late. The Financial services are also part of a new form of Robo-Advisors. This is another form of artificial intelligence. From here on, related services are going to be transformed into a new level all together.

The change is here and FinTech and Bitcoins are also an alternative way of investing. That would add on to the list of asset allocation in the previous posts. There are plenty of alternative asset classes. Don’t fall prey to unreal ones so always do your DUE DILIGENCE (DD).

Only Steve Jobs believed in the future of smart phones and tablets before it came here today.

“If at first, the idea is not absurd, then there is no hope for it.” – Albert Einstein