Just earlier today. I wrote a piece about saving money and I was reminded of petrol prices. Stay tuned until the end for a nice freebie at the end which is in limited stock.

Sometimes saving money is about not spending it at all or cutting back on what we commonly call an austerity measure. Usually, that is quite drastic and meant to be a joke of some sort. However, some things have to be spent, necessities or even things that you have previously committed to paying for. It is akin to having a car and petrol prices are directly linked to costs.

For Example:

- You purchased a home. You can’t stop the mortgage

- You purchased a car. You can stop the financing payments (If any) and the petrol costs or the charging costs.

- You purchased a subscription plan that has a contractual period. You can’t stop the payment. (Well, you can do an early termination if it makes economic sense)

I don’t wish to keep discussing the increase in GST. In a sense, this increase is necessary for economic gains and country-building. Additionally, business costs have increased, snowballing effect of the laggard inflation and upcoming soft landing is becoming apparent.

Petrol Prices

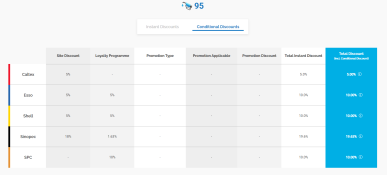

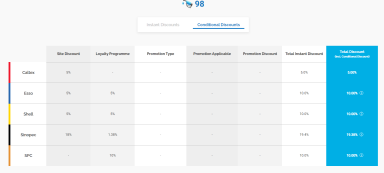

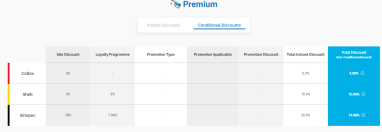

Discussing petrol prices has always been contentious with people around here. Regardless of any discussion, the price is as such. On the Price Kaki website, there’s a comparison of petrol grade 95, 98 and Premium.

In this year 2024, I wish to be able to bring joy to others as much as possible so in that aspect I have a good deal for anyone who drives a car and would like to get direct discounts from the petrol kiosk.

Don’t be confused and don’t be sceptical about it. It is a good deal and I have been using it for 9 months now so it is not a sham. I have a limited fleet card on hand at the moment and would like to offer to the first 5 pax who indicate their interest on google forms here: Fleet Card Interest Gathering and First 5 GIveaways.

One condition is to follow/subscribe to my blog and also to add my telegram channel here at Life Journey Telegram. Thank you!

The first lucky 5 gets it.

Rest assured, this information is for me to understand how to address you and share that information via email. I’m gathering some interest here so let me speak with the guys and see if we can release more slots for you.

Save on Petrol Prices – Pros

1. No age or salary restriction

This is not a credit card. Anyone who has a vehicle registered in Singapore has proof of address in Singapore and a credit card for recurring payment can apply for this. There’s no bank involved in this.

2. A physical card

It is a physical card at the moment and is only available to ESSO and SHELL kiosks in Singapore.

3. Fabulous Discount on petrol prices

Perks for this card are a direct 23% or 24% for SHELL and ESSO respectively.

4. No Complications. No minimum spend or Top Up

Away with the complications of minimum inclusive spending and potential discounts. To me, cold-hard discounts are the best since they are upfront discounts.

5. Ease of Payment on petrol

This fleet card works like a credit card and you need to set up a credit card payment to pay once a month.

6. Convenience

Once you have been registered by the company, you will get a pin and each time you visit the kiosk, just the card and you can skip the cashier queue. That’s really convenient.

7. Continue to earn credit card rewards/miles/cashback

Even more, discount via double dipping and still be rewarded with your credit card rewards.

Save on Petrol Prices – Cons

1. New to Many

I understand the scepticism but what have you got to lose other than savings for your petrol.

2. No accumulation of reward points on your petrol loyalty card

You don’t earn kiosk points or rewards that you have accumulated for some time. To me, there’s a cost to everything including reward points. Just finish up your points or claims and move on to something else. But you still earn reward points for your credit card (No exclusion for most cards – At least I still earn mine on my Premier Miles Card)

3. There will be a 1.8% fee for the credit card charges

I believe that they use Stripe as their provider so the B2B fees will be at 2.4% and they roll it to consumer at 1.8%, hence the discount will be All-in 21.2% or 22.2% which is still decent.

From what i understand, one can use the giro payment and it takes 4-8weeks to set it up. There’s no fee for that however if any one Giro payment fails, thats the $10 fee slapped on your bill for the GIRO return so think wisely. I think it is still good to go on credit card recurring payments.

If you like what you are seeing, do remember to check them out and do your diligence. There is no one-size-fits-all investment strategy and no one solution to life. Join my telegram group to find out more about deals and join the community to connect for ideas: Life Journey Telegram

I have a limited fleet card on hand at the moment and would like to offer to the first 5 pax who indicate their interest on google forms here: Fleet Card Interest Gathering and First 5 GIveaways.

If you like what I am sharing or if it resonates with you, do use my referral codes here at Referral Services