Here is yet another robo advisor that I get on my portfolio since the start of 2020. It has been okay I feel. Ever since 2020, it has been a year and till today – I’m not exactly convinced though.

I am caught in both minds. I like reits but yet I don’t quite like Singapore equities in general. Dividend paying equities are definitely good but yet I have more appetite for a growth company. It is just not that sustainable over the long term I feel. Where are the money coming from to build more creativity and expand their business.

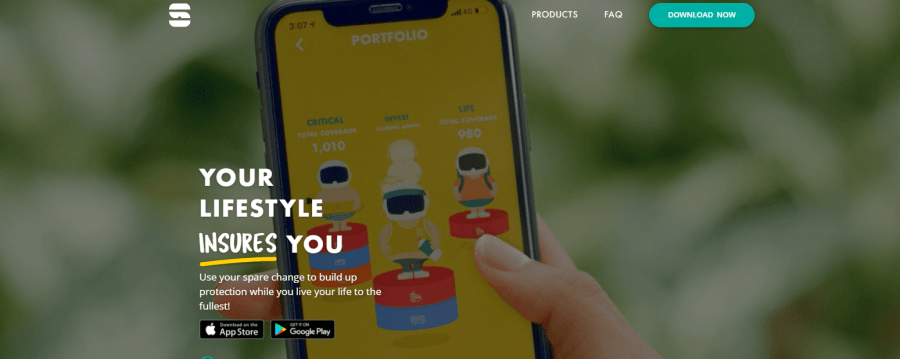

Why Syfe?

When the markets were down during March 2020, it was quite exciting times because those were the kind of period which I actually will put money into investments. To a certain extent, I have also put money into other robo advisors such as Endowus and StashAway. While those are more of a “global diversification”, Syfe is more of a local bias for it’s Reits+ Portfolio and truth be told I then took the plunge for a small amount just to try it out a non-DIY approach to Reits investing.

Next, what I struggled with then over the period is that there were quite a discount off many equity tickers and I didn’t really know what to buy or what to expect since the market was in a downtrend. As with every investment, making a rational or emotional decision can only be determined after the event has passed. Reits has since risen, dropped and risen yet again. Frankly, I’ve been busy to keep looking into my own portfolio.

I haven’t got around to increase the investment funds so it is only a very small initial amount. Partly, my mind tells me to do dollar cost averaging for my other investments so we still have to see how things go.

Performance (August 2021)

12 months has gone by and +28.65% is pretty insane in my opinion. The last time I looked at this was 6 months ago in March 2021 and it has increased by slightly more than 5%. Then again, the base that I started out with is quite a fantastic benchmark so maybe that isn’t too fair. From here, there isn’t fresh funds invested as I am think more about my overall portfolio. I do think I have enough of the local investments and typically Singapore equities are rather slow and neutral in performance. Even the STI isn’t that exciting in my opinion. If you really look at a 50 year and beyond horizon for S&P 500, it is an amazing uptrend with good returns.

Do use my referral code to get some benefits when you sign up a new account with Syfe. Referral Code: SRPTSMQ5J

You will get (Find our more about their referral scheme here Syfe Signup) :

a. S$10 bonus if you invest S$500

b. S$50 bonus if you invest S$10,000

c. S$100 bonus if you invest S$20,000

Disclaimer

This is not a sponsored post. This is purely my own opinion after using their service and/or products. If you like what you are seeing, do remember to check they out and do your diligence. There is no one size fits all investment strategy.

If you like what I am sharing or if it resonates with you, do use my referral codes here at Referral and Recommendations

The pictures were taken from Syfe website for this article.