Revisiting a tech online portal that Income has developed over the years. It is not a great app since it wasn’t developed fully in my opinion but it does dole out a nice reward over time. It also helps to supplement whatever insurance that I currently have as a risk transfer.

Why Insurance?

Let’s face it. Everyone needs to transfer their risk and that is a fact. Whether it is a term or a whole life plan, is up for debate but no best answer. You need health insurance, life insurance, disability insurance, travel insurance, car insurance, and the list goes on. The challenge to DIY stuff is that although it comes cheap you have to figure out how to do that on your own. Nothing wrong with that but it comes in as a pain when you don’t have time to manage those stuff.

Try Microinsurance

Personally, I feel that it is fine to try out a cheaper alternative to insurance just to get yourself covered at the lowest cost possible. SNACK is by Income and they did not have this concept of microinsurance. I find it appealing personally coming from someone who understands how these things work. It kind of supplements what I have existing.

At least they try to speak the millennial language. Next, I find that with such low-cost products – There will be fewer barriers to entry. The difficulty in this solution is to educate people. It is much easier to say that it is complicated than trying to find out what this is all about.

Once you sign up online and register the amount you can commit daily, every document will be sent to you via email or digitally. Quite simple.

There are 4 ways you can choose to buy insurance (Choose 1 or whatever you need but the auto-invest is the one that gives out e-CapitaVouchers):

a. Critical Illness

b. Personal Accident

c. Life Insurance.

d. Investments – There is a new weekly limit for the RSP style on the Asian Income Fund. There’s only one fund and I also believe the NAV versus the Sell (Also known as bid price) will be different from the Buy (Ask price) That’s something I don’t quite like about insurance firms. They need to do away with this (With the fact that they tell customers there’s no front-end or back-end loading). This itself is the spread.

Recently, there’s been a monthly mission and a single top-up mission that one has to invest and hold for a month before the team releases e-CapitaVouchers via email on fulfillment. It’s not too bad and ranges from a cashback of approximately 5-8% depending on the investment amount.

The cons is that the system is not great. You can’t do partial withdrawal, there is only one Asian Income Fund, and it comes with a buy-sell spread (Fees and management fees from the fund). Also, the max investment is $1000 weekly so there’s a bit of micro-management and exploring how bad the app is to figure out how to not tweak the limits any period as the change actually reset the period.

Missions also are limited to 28-29 days – so if you miss a day, you miss out on the big prize. The challenge prizes have also been reduced over time but that is expected.

Be careful since it is still an investment but no harm in trying after exploring and figuring it out.

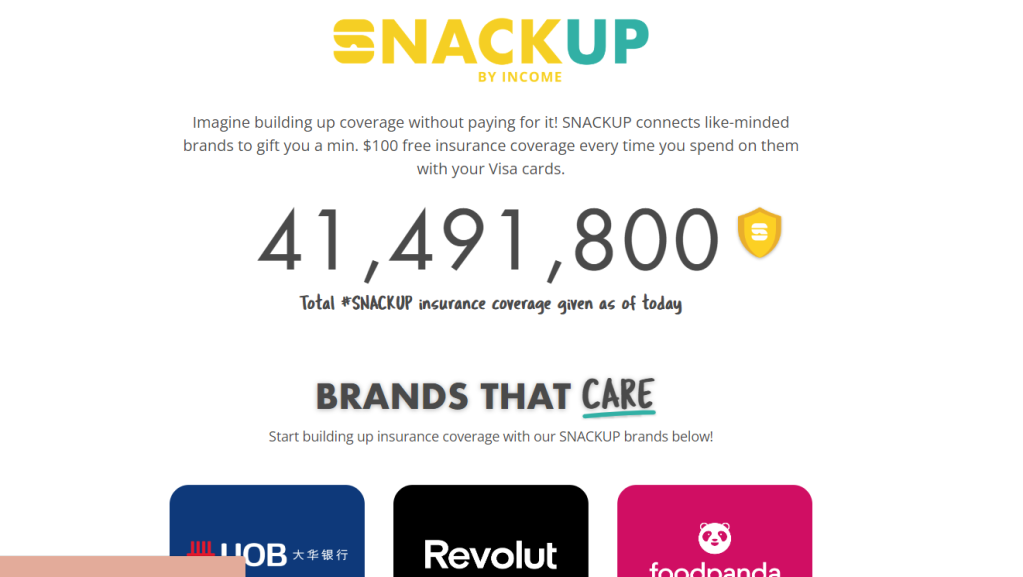

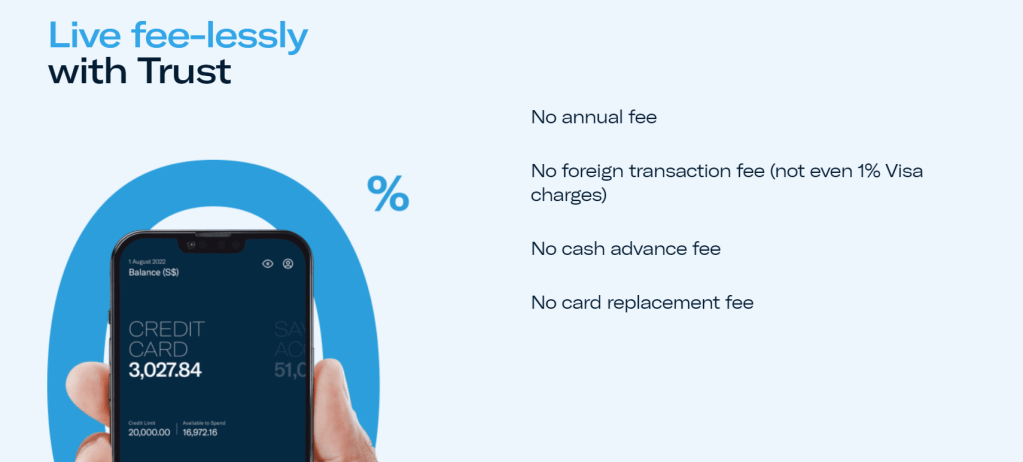

You can also trigger these daily costs from a few parts:

a. Redeeming deals or paying for meals using a VISA card.

b. Commuting by bus, train, or cab and paying for it using a VISA card.

c. Through retailing and purchases using a linked VISA card.

d. Shopping for groceries using a linked VISA card.

e. Through entertainment and paying using a linked VISA card.

f. Topping up petrol and paying using a linked VISA card.

g. Pay your utilities and pay using a linked VISA card.

h. Activate your Fitbit app and fulfill your daily steps.

You may be thinking what happens if you hit every objective. There is a limit to the premiums charged to your credit or debit card depending on the weekly cap you’ve set up. Once you’ve hit this weekly cap, SNACK will no longer charge you premiums when you complete lifestyle triggers and you will not be issued any more policies for that week.

The minimum amount daily you can set is $0.30 and you can add on as many triggers as you wish.

There is also a cap on each insurance segment:

a. For Personal Accidents, the cap is at $100,000

b. For Life Insurance, the cap is at $200,000

c. For Critical Illness, the cap is at $200,000

These insurance are known as non-participating policies so the moment you stop paying for these, the coverage will stop. To me, it is a stop-gap kind of coverage and at an extremely low cost. If you are looking at the full suite, take time to understand and learn. You will definitely benefit from the knowledge and to suss out your new insurance agent. Whether they are in it for the long term or to hit and run. We will never know unless we experience and have the basic knowledge.

Disclaimer

This is not a sponsored post. This is purely my own opinion after using their service and/or products. If you like what you are seeing, do remember to check them out and do your diligence. There is no one-size-fits-all investment strategy or general rule for your every life. Join my telegram group to find out more about deals and join in the community to connect for ideas: Life Journey Telegram

If you like what I am sharing or if it resonates with you, do use my referral codes here at Referral Services

The pictures were taken from the SNACK website for this article. If you need a referral code, please use my referral code “PAU4055” to sign up at https://www.snackbyincome.sg/ to find out more.