My part 2 version came a year and a half late. My apologies really.

In the previous discussion, I discussed about retirement. In the past, it was a buzzword only for people in their 40s or 50s. That is quite normal I would say. Given the financial literacy and knowledge of Generation X. Not many people make an effort to think about the future. I would say that partly it is due to the conditions of the past and education. Fast forward 30 years, the trend is gradually changing. The young are concerned about their futures and the future of their younger ones. An additional factor is that personal finance and financial literacy are increasing among the young.

Including myself, I love my kids and I want the world to be in a better place than it was when I am no longer around. It depends on which stage everyone is in. Some people have more resources while others have lesser. However, that does not make you any less by starting out early. Even if you are late to the game, making the start of this means that you are already on your way to some form of freedom.

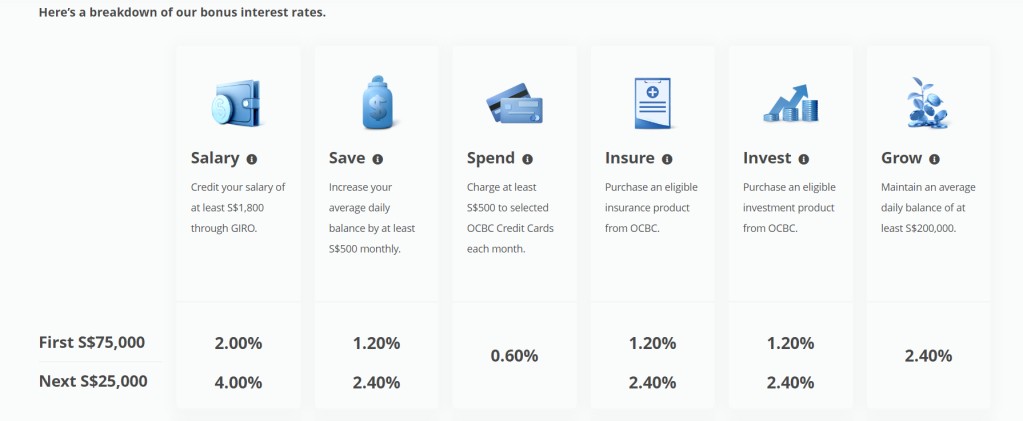

There are so many investment tools out there in the market to put your money in and it’s a matter of understanding the risks and taking the right risks to grow your money. Of course, the basic step is to spruce up an emergency fund first. You cannot confuse your pot to be of multiple use. Different funds that you raise have to be for a different purpose. If you have fewer resources, then focus on the things that will give you the confidence such as building a pot of emergency funds. For example, 9 months’ worth of extras. Do not undermine the power of achieving milestones because the small effort often counts for bigger things to come.

Once your basics are covered. We have to think about the next step of risk – This is the part where I term it as risk transfer. This is short is coined as Buy an insurance. The basics are buying your personal health insurance and protection against illness, treatment, sudden medical conditions as well as other unforeseen circumstances. Life itself is uncertain and as time goes by, it will be more prevalent. Getting insurance is never enough but there are many ways to kick-start that. It also involves a bit of planning.

I’m no financial expert. All I know is you probably should find out more to convince yourself that you need to risk transferring your future.

a. Health Insurance

b. Whole Life Plans with TPD or Term Life Plans or Hybrid Plans

c. Critical Illness

d. Early Payout Critical Illness

e. Disability Income or Elder Shield Enhance

I’ll say start working with the Health portion followed by Death or permanent disability coverage. Because if you are gone, your potential future earnings are gone and your dependants depend on them. Once you have covered yourself, then start thinking about the rest. Baby steps. This works well if you are still young.

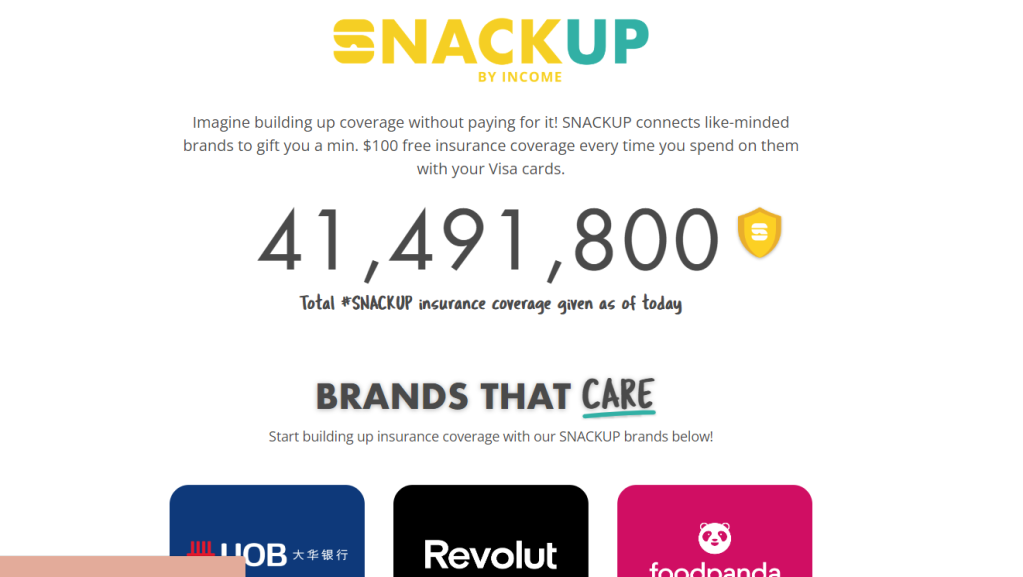

Things like Mindef or MHA term insurance coverage or SNACK Income microinsurance work well to supplement this insurance at a low cost. That’s something most advisors probably would not share with you.

That’s probably enough information for Part 2. We should talk more about insurance in Part 3.

Disclaimer

If you like what you are seeing, do remember to check them out and do your diligence. There is no one-size-fits-all investment strategy and no one solution to life. Join my telegram group to find out more about deals and join in the community to connect for ideas: Life Journey Telegram

If you like what I am sharing or if it resonates with you, do use my referral codes here at Referral Services