Value is a very interesting concept. In the world of investing and valuation of companies, there is no one size fit of the valuation of a company. This also create an inefficiency into the market where there are enough buyers sellers to take in price and also to sell out. This is also a great definition to split up what buyers and sellers view certain companies or certain things. This is extremely interesting for me – Over the years there is no doubt brands bring out a certain stature in beings. (Beings as in humans) In Singapore – The last 10 years have seen a big bunch of folks growing with affluent wealth significantly.

Perspective

Let me just put things into perspective – many might know what a KIA Picanto is. Just about 7-8 years ago, COE prices were sky rocketing to above S$80k. The brand new Picanto actually cost cost to a S$100k here and I actually do know some people who own these. With the same S$100k, you can actually get a Toyota Vios or a car with a smaller engine such as the Toyota Yaris (Which is a sportier hatchback). To some, owning a car is just not feasible or it just doesn’t make sense. This is where things get interesting. For S$120k, you can almost get into the entry level continental cars such as Audi, Skoda and Volkswagen. Driving an Audi versus a KIA – what perceived value do you now have?

Concept

Before beginning on the concept, i need to have a disclaimer that I am not a qualified psychologist nor am I a specialist. I just find that stuff like Feng Shui, Human Psychology, Behaviours and Ideas are built on a single platform. This platform is known as Common Sense. While it is easy to understand, many may not practically use or realise until much later.

For me, I think that it is necessary to always stay an open mind. There isn’t really such a thing as a one man show, it is always a team effort to succeed in a project.

A Story to tell about

Side tracking a little about team effort. This reminds me about a story. I knew something who was working as a Management Associate working in a bank many years ago. The selfish bugger intentions were to let the higher ups know that he single handedly solved and produced many solutions for the bank. In reality, he simply used his intern or ex-intern to do so. In summary, he took all their work and claimed the full credit. Why? I don’t know. Perhaps for the money? Most likely that is the case.

Currently, he heads a department but he is an empty shell. This is simply because he gives no credit to those below him. That’s no way a good boss should behave. He is no role model and in no capacity to lead people.

Value

It is precisely because different people view value differently, the variation of behaviour changes from one to another. Even family members do not behave or think the same. This “unique” behaviour is partly why there are so many inefficiencies in the equity market. At any point in time, there are sellers and buyers in the market. That was how a buyer and seller market was formed. Then came the “trend followers” – Because everyone enters into a position, they create a buy volume or trend which pushes the momentum of the company. Often, that is translated to share price as well. However, always remember that the price on the stock market is the sentiment of an investor, not the situation which the company is in.

Herding

Over time, people behaviour will naturally act as a herd. When the momentum is to buy or sell, a natural phenomenon is to follow. If you follow, it doesn’t feel like you are missing out. This theory actually touches an emotional aspect of our being that we do not like to be left out. That sounds a little needy but as humans, we are generally weak in such situations. Hence, the word “FOMO” appeared. It means Fear Of Missing Out especially when cryptocurrency coins started to increase exponentially to 100x or 1000x. No one likes to miss out on a good deal.

Not saying yes to everything

Well, I can’t really say much about when is good time to buy unless you are an insider. That being said, it is illegal because it is not a level playing field. Eventually, you will be exposed so make money the right way. I guess that only successes and failures bring experiences.

You can’t just buy anything and everything. There’s the existence of curating for a reason. You have to understand and know what are you buying certain stuffs for and what is your exit strategy.

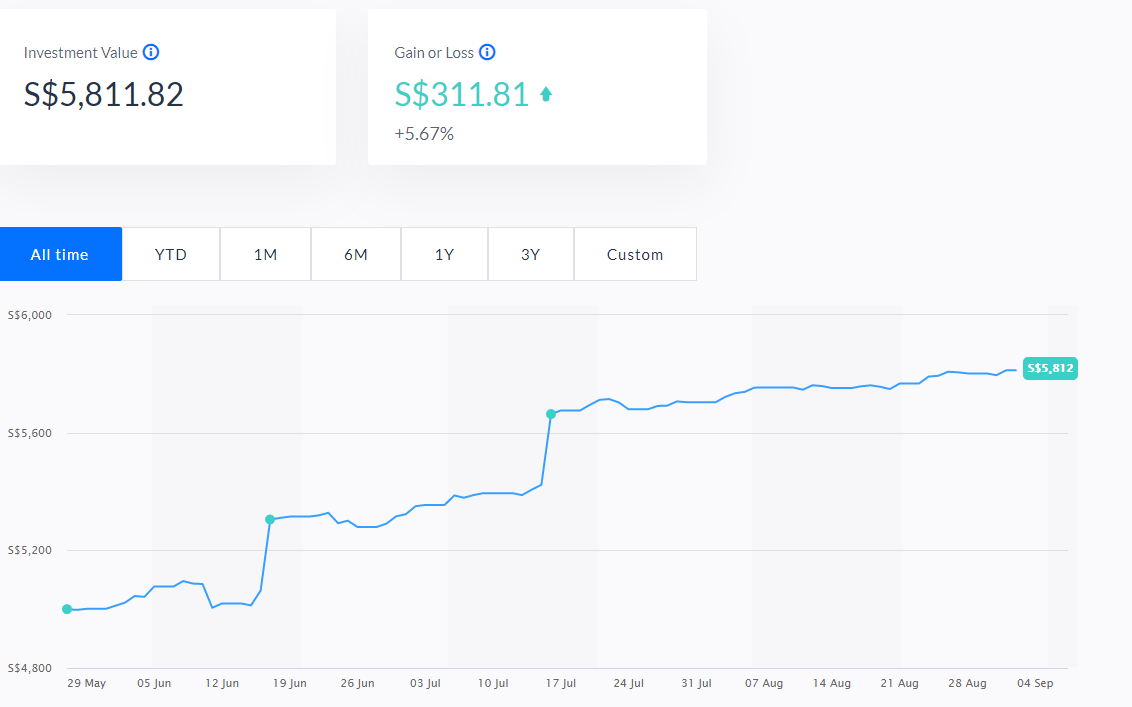

There are things eventually that you can take risks on and some you don’t. That does not mean that it is not a bad thing. I am an advocate that if there is something new that is worth investing or exploring. Try it out with an open mind. You can be disappointed for 99 times but it only take 1 opportunity to get it right.

Disclaimer

This is purely my own opinion that I am writing about in my thoughts. If you like what you are seeing, do remember to check they out and do your diligence. There is no one size fits all investment strategy.

If you like what I am sharing or if it resonates with you, do use my referral codes here at https://atomic-temporary-178675883.wpcomstaging.com/contact/ for the services.

Images seen in this article were take off the relevant websites for illustration purposes only.