Something interesting came in my way last week. I managed to speak with the General Manager of Wellnex (Link here if you are interested to find out – https://www.wellnex-singapore.com/) and My-insurer. (Link here – https://www.my-insurer.net/) They are in the field of Insurtech field – Insurance Technology. (Something that works differently as compared to the traditional agents who sells you an insurance) I’ll say that they are more of a 99.co or property guru in Insurance style but with a tad more zest as all interactions and details are done digitally so it is as good as meeting the customer face to face. Given current Covid situation, I’m not sure if I want to meet anyone face to face for a 2-3 hour chat about personal finance.

It isn’t a sponsored post. I’m very strict with the way things are being done regarding a sponsored post. As the way it is, I’m happy to write and type whatever my views are and trash whatever I find is trashy. In any case, my-insurer has a separate wellnex platform – which is more of a deals, news, more information kind of portal where businesses and writers can create and post articles.

The Wellnex Interface

In terms of user-interface, it is simple – no frills but also nothing fancy. The whole idea is to create content, display them out and get people to read them. Hopefully, some people actually think that my content is worth reading. I am a firm believer of things taking time to grow organically. Spending marketing dollars on stuff is what companies who have cash to burn does. Usually it comes with a price, there is always a catch or ROI to it – Then the marketing dollars will eventually be reduced or some others suckered into buying into it and spending even more marketing dollars.

Data Trustmark

Sometime last week, i received an email from them stating that they have achieved the Trust-mark for Data Protection so you can be sure that there is a standard or ISO for dealing and protection the data that you store with them. I’ll say that is a good job considering that they hold key to agents and customer data.

What I really do like about them is that, they have no requirement for me to have at least one post per week or anything of that sort. There isn’t a fee that they pay to me or I need to pay them for using their application to post articles as they wish to stay neutral and free from conflict of interest. That is respectable for a business who work on that ethics. Not many companies are true to what they preach.

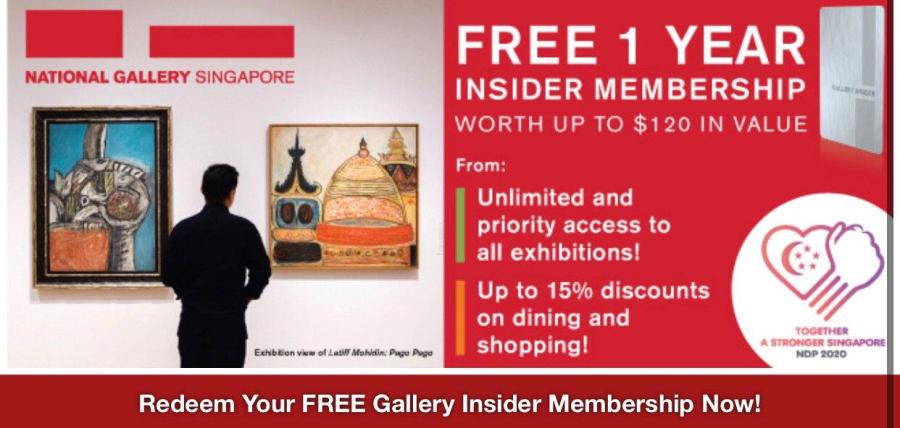

Help one another / Refer a good deal

If you own a company or wish to share some deals, do reach out to these folks out there. Perhaps, they can add more marketing value for space or reach or impressions as the marketing guys call it. After all, the idea is to get what you have out there so people know and talks about it.

The whole idea that I wish to do is to create a space where people enjoy reading articles about finance. Perhaps, get them excited about finding out what is out there. What is the current trend? Sometimes, even finding a good deal or good idea will come back. Though I did not start out as early as so many other bloggers did, it is never too late.

Eventually, finding out and working together as online bloggers is something I wish to build in the community. I started out reading financial blogs for many years. In the process, I procrastinated about building one as it takes up too much time. However, the circuit breaker forced me to take on something that I have put off for many years. I hope I will grow my project to a sizable one in the near future.

Disclaimer

These are just solely opinions of mine. Different people have different needs, requirement, financial situation and views. For me, this is what I would do if I would like to build my blog. The main aim to to get more viewership and subscribers to keep the lights running.

If you like what I am sharing or if it resonates with you, do use my referral codes here at https://atomic-temporary-178675883.wpcomstaging.com/contact/ for the services.

The pictures were taken from Wellnex website for this article.